Irmaa 2025 For Part D

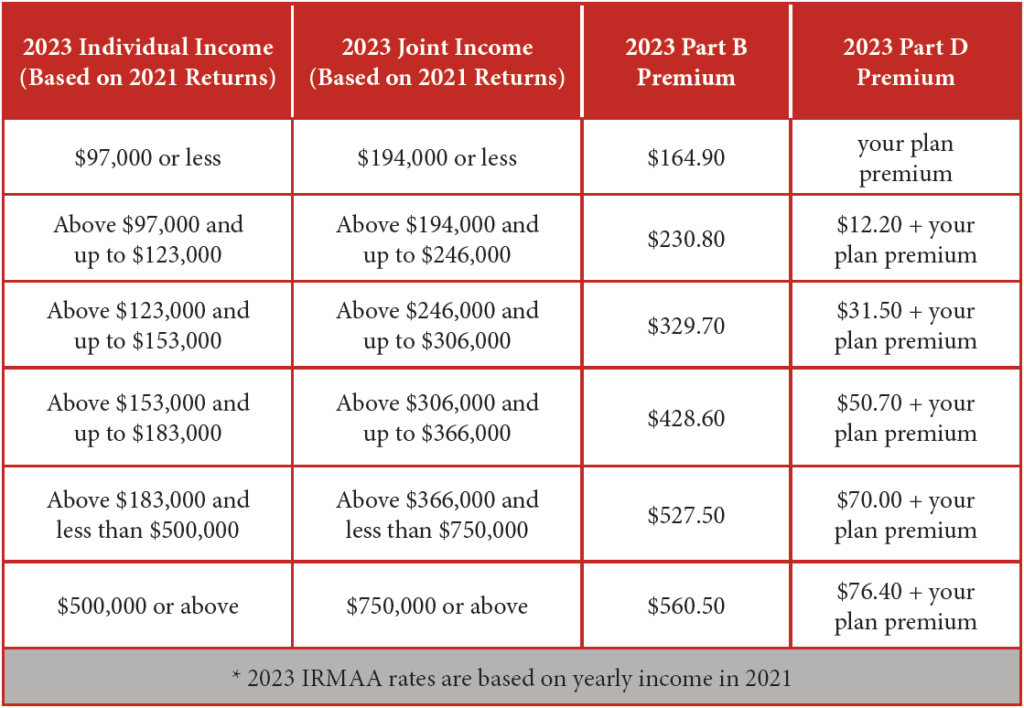

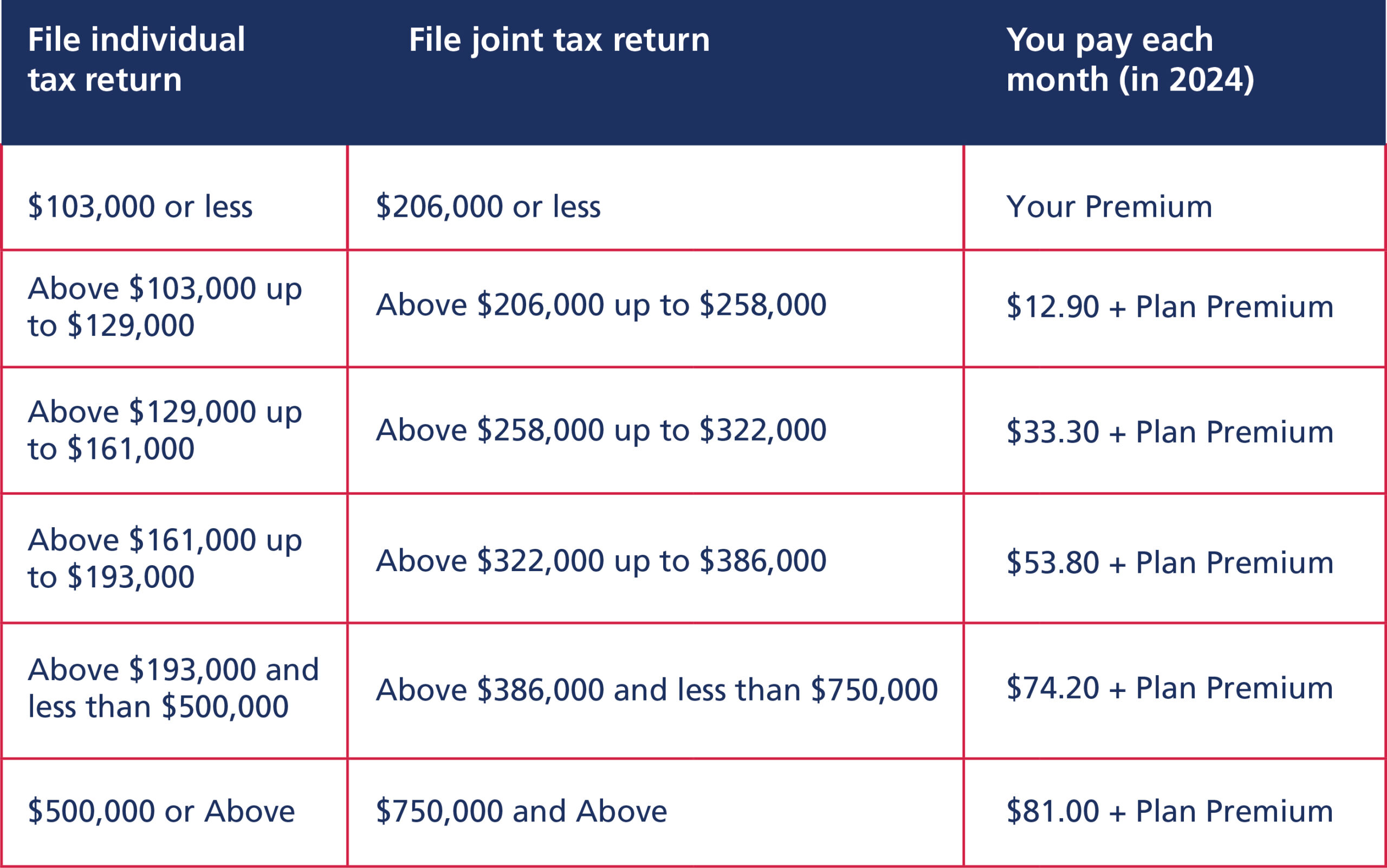

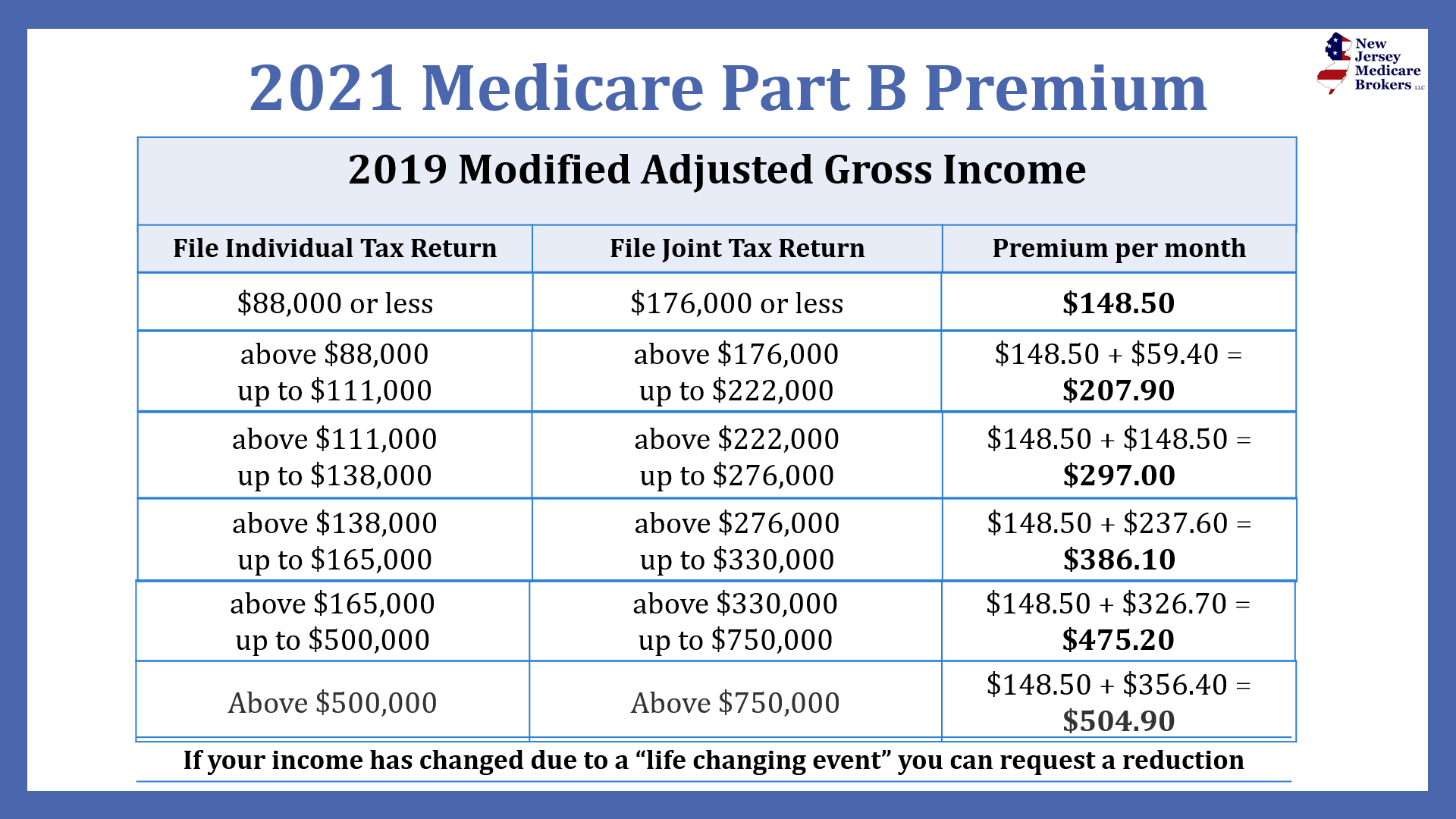

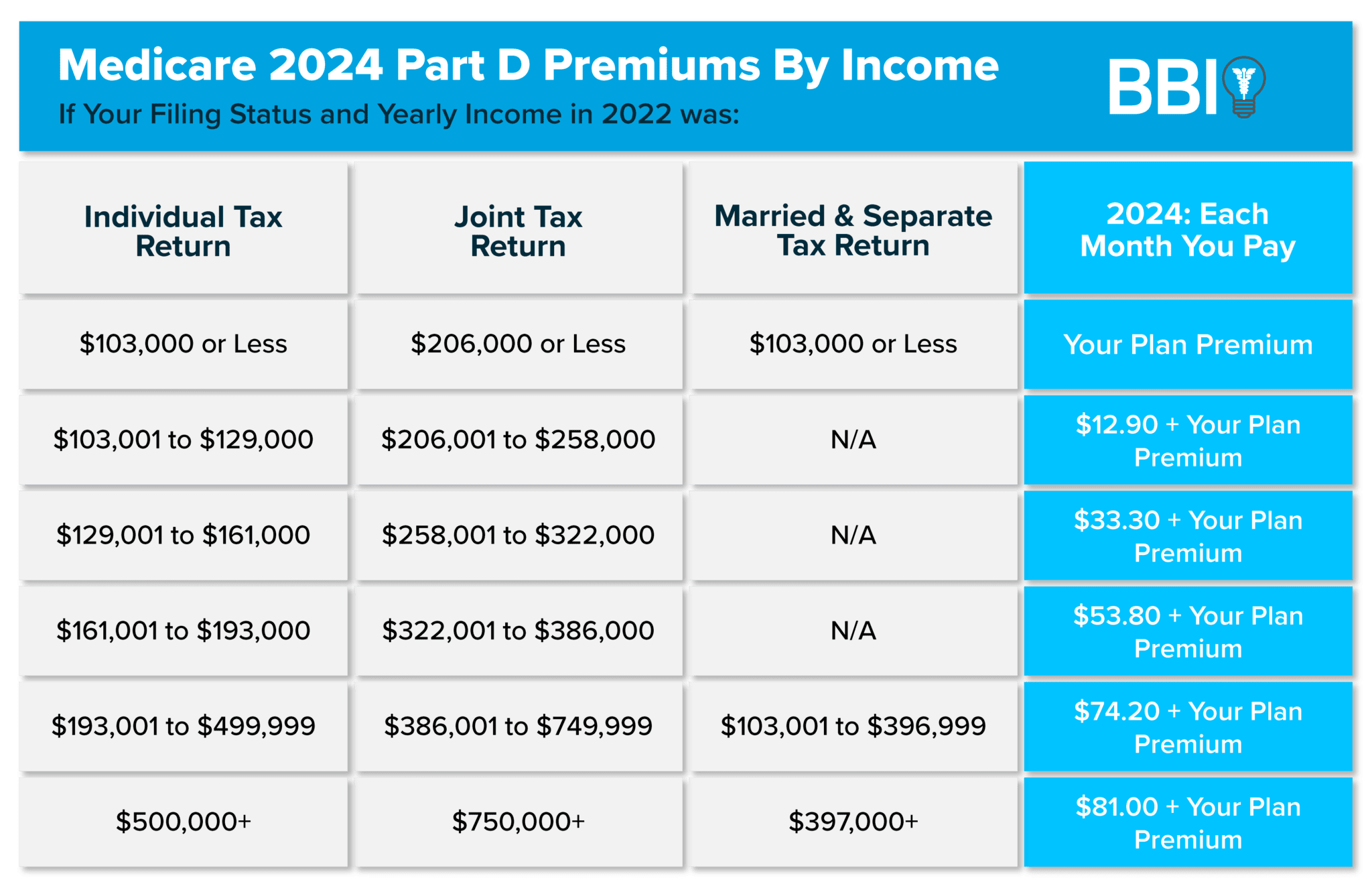

Higher income medicare beneficiaries pay more for medicare part b and part d premiums. The ira made several improvements to the standard part d drug benefit defined in the social security act.

In 2025, you’ll need to pay the part b and part d irmaa charges if you make more than $103,000 filing solo or $206,000 filing jointly. On october 12, 2023, the centers for medicare & medicaid services (cms) released the 2025 premiums, deductibles, and coinsurance amounts for the medicare part a and.

For 2025, If Your 2022 Income Was Below $103,000 As An Individual Or Below $206,000 As A Married Couple, You Will Not Be Subject To Irmaa.

If you are charged a medicare part d irmaa for your prescription drug coverage and notify the division of retirement and benefits, you will be reimbursed for.

Most Other Medicare Part D Beneficiaries Earning Over.

There are different irmaa costs.

Images References :

Source: amiiqauguste.pages.dev

Source: amiiqauguste.pages.dev

Irmaa Levels For 2025 Inge Regine, You can use information from your 2022 tax form to calculate your magi, but. Higher income medicare beneficiaries pay more for medicare part b and part d premiums.

Source: ronaldawtilly.pages.dev

Source: ronaldawtilly.pages.dev

Irmaa Brackets 2025 Pdf Form Daphne Christal, If you fail to enroll in a part d prescription drug plan and do not have other creditable prescription drug coverage, such as a plan offered by your. Most other medicare part d beneficiaries earning over.

Source: medicareresourcesusa.com

Source: medicareresourcesusa.com

Part B and D IRMAA Medicare Resources USA, You can easily assess how irmaa affects your part d. What are the 2025 irmaa brackets?

Source: help.checkbook.org

Source: help.checkbook.org

IRMAA Related Monthly Adjustment Amounts Guide to Health, There are different irmaa costs. What are the medicare irmaa brackets for 2025?

Source: thomasawvinny.pages.dev

Source: thomasawvinny.pages.dev

Irmaa Brackets 2025 2025 Nj Auria Octavia, To determine whether you are subject to irmaa charges,. Most other medicare part d beneficiaries earning over.

Source: www.youtube.com

Source: www.youtube.com

2025 Medicare IRMAA Explained YouTube, In 2025, you’ll need to pay the part b and part d irmaa charges if you make more than $103,000 filing solo or $206,000 filing jointly. If you are expected to pay irmaa, ssa will notify you that you have a higher part d premium.

Source: chrysaalibbey.pages.dev

Source: chrysaalibbey.pages.dev

When Will Irmaa Brackets For 2025 Be Announced 2025 Tiffi Gertrude, 2025 irmaa cost sharing for higher income medicare beneficiaries. For 2025, your irmaa status is determined by your 2022 modified adjusted gross income (magi).

Source: bobbybrockinsurance.com

Source: bobbybrockinsurance.com

Your Guide to 2025 Medicare Part A and Part B BBI, However, if your income is higher than. The ira made several improvements to the standard part d drug benefit defined in the social security act.

What are the adjusted Part B and Part D premiums for IRMAA in 2025, The irmaa for part b and part d is calculated according to your income. Most other medicare part d beneficiaries earning over.

Source: meldfinancial.com

Source: meldfinancial.com

Medicare Premiums and Coinsurance Raised for 2025 Meld Financial, There are different irmaa costs. For 2025, your irmaa status is determined by your 2022 modified adjusted gross income (magi).

For 2025, If Your 2022 Income Was Below $103,000 As An Individual Or Below $206,000 As A Married Couple, You Will Not Be Subject To Irmaa.

In this comprehensive irmaa guide, i’ll guide you through the fundamental changes, income thresholds, and strategies to navigate the 2025 irmaa landscape.

If You Are Expected To Pay Irmaa, Ssa Will Notify You That You Have A Higher Part D Premium.

The ira made several improvements to the standard part d drug benefit defined in the social security act.

Posted in 2025